Time-Based Coding in Mental Health: Getting It Right with Psychotherapy Sessions

by admin |March 02nd, 2026| 6 comments,

In mental health billing, accuracy is everything. The codes you choose determine not only reimbursement but also compliance with payer and regulatory expectations. Among the most critical areas of precision is time based coding for mental health billing especially when it comes to psychotherapy sessions.

Running a pediatric dental practice in New York comes with a unique set of rewards and equally unique challenges. Beyond keeping up with young patients and their parents, providers must also navigate a highly specific and often complex billing landscape. Between Medicaid requirements, frequent insurance policy changes, and documentation demands, pediatric dentists in New York face a steep climb when it comes to getting paid on time

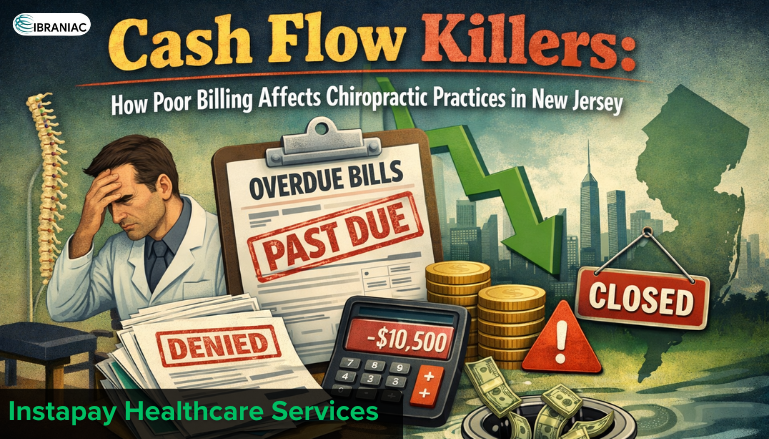

Cash Flow Killers: How Poor Billing Affects Chiropractic Practices in New Jersey

by admin |Feb 10th, 2026| 6 comments,

In a field as hands-on as chiropractic care, billing often becomes the silent disruptor of financial health. Chiropractors in New Jersey aren’t just managing spinal adjustments and patient care they’re also navigating a maze of evolving payer requirements, coding rules, and compliance hurdles. When billing processes break down, so does cash flow and the impact can be felt across every aspect of the practice.

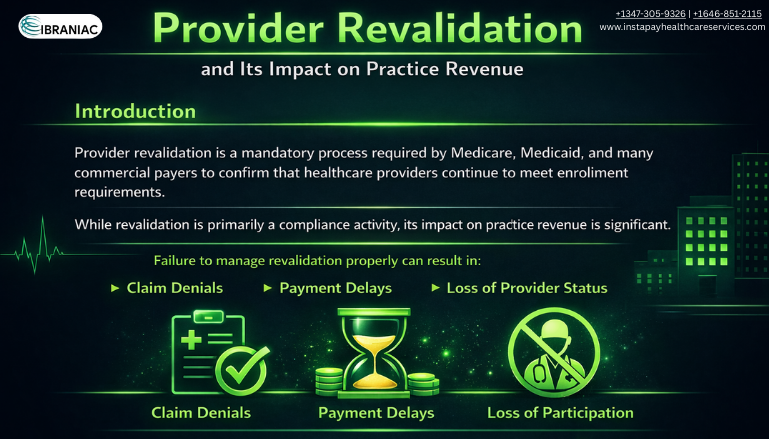

In today’s complex healthcare environment, administrative accuracy directly affects financial stability. One often overlooked requirement that can significantly influence cash flow is enrollment maintenance. Healthcare provider revalidation is a mandatory process that ensures payers have current and accurate information about clinicians and organizations. When managed incorrectly or delayed, it can disrupt operations and reimbursement cycles. For medical practices, understanding this process is essential to maintaining financial stability.

Hidden Revenue Impact of Incorrect Group Enrollment Information

by admin |Jan 28th, 2026| 6 comments,

Managing provider enrollment is one of the most important administrative functions in any healthcare organization. Yet it is also one of the most overlooked. Many practices focus heavily on coding, billing, and collections while unintentionally ignoring the foundational data that determines whether claims are even eligible for payment. That foundation is group provider enrollment. When the information attached to your group is inaccurate or incomplete, the financial consequences add up quickly.

Understanding the Difference: Patient Verification vs. Eligibility Verification

by admin |Jan 21st, 2026| 6 comments,

In the world of health care revenue management, two terms often sound similar yet serve very different purposes. These terms are patient verification, eligibility verification, and they are essential for practices that want accurate claims and stable cash flow. As clinics, hospitals, and billing teams continue to face rising claim denials, understanding the difference between these processes is more important than ever. Strong workflows supported by effective medical billing solutions from services providers like Instapay Healthcare Services can prevent financial loss and create a smoother experience for both staff and patients.

Cash Flow Killers: How Poor Billing Affects Chiropractic Practices in New Jersey

by admin |Jan 15th, 2026| 6 comments,

In a field as hands-on as chiropractic care, billing often becomes the silent disruptor of financial health. Chiropractors in New Jersey aren’t just managing spinal adjustments and patient care they’re also navigating a maze of evolving payer requirements, coding rules, and compliance hurdles. When billing processes break down, so does cash flow and the impact can be felt across every aspect of the practice.

Just Opened Your Chiropractic Practice? Your First Provider Enrollment Checklist

by admin |Jan 09th, 2026| 6 comments,

Starting your own chiropractic clinic is an exciting milestone , but before you begin treating patients and submitting insurance claims, there’s a crucial administrative task you need to get right: chiropractic provider enrollment.

Charge Capture vs. Coding: Understanding the Difference and Why Both Matter

by admin |Dec 15th, 2025| 6 comments,

In the complex world of healthcare revenue cycle management, two critical processes often come into focus charge capturing and medical coding. While both play essential roles in ensuring providers get paid accurately and on time, they are not the same thing. Understanding the difference between them and how they work together is key to preventing revenue loss and maintaining compliance.

Celebrating the Season of Care, Growth, and Revenue Excellence

by admin |Dec 15th, 2025| 6 comments,

As the year comes to a close, Christmas brings with it a season of reflection, gratitude, and fresh beginnings. At Instapay Healthcare Services, we believe this is also the perfect time for healthcare providers to strengthen their revenue cycle, streamline operations, and step confidently into the new year with financial clarity.

Provider enrollment is one of the most critical processes in healthcare revenue cycle management. Unfortunately, it’s also one of the most misunderstood and error-prone areas. Inaccuracies or delays during enrollment can lead to denied claims, lost revenue, and serious interruptions in care delivery.

Pre authorizations can be one of the most confusing parts of the reimbursement process for chiropractic providers. Yet they play a critical role in helping practices secure timely payments and avoid claim denials. At Instapay Healthcare Services, we work closely with chiropractic clinics to simplify this process and improve financial outcomes. This blog breaks down how pre authorizations work, why payers require them, and how your team can manage them more effectively.

Running a healthcare practice as a solo provider comes with many responsibilities. One of the most important tasks for maintaining financial stability is accurate and timely solo provider enrollment. When mistakes occur in this process, the consequences can directly affect solo practice revenue. At Instapay Healthcare Services, we help providers understand how errors happen and how to prevent them so their practices stay financially healthy.

Unlocking Audit Excellence: A Comprehensive Guide to Prospective, Concurrent, and Retrospective Audits

by admin |Dec 02nd, 2025| 6 comments,

In the world of excellent guarantee and compliance, audits play a pivotal position in making sure adherence to standards, figuring out areas for improvement, and mitigating risks. This article delves into the intricacies of different audit kinds prospective, concurrent, and retrospective highlighting their unique functions and importance in maintaining high-quality and compliance across various industries.

Hidden Revenue Impact of Incorrect Group Enrollment Information

by admin |Nov 28th, 2025| 6 comments,

Managing provider enrollment is one of the most important administrative functions in any healthcare organization. Yet it is also one of the most overlooked. Many practices focus heavily on coding, billing, and collections while unintentionally ignoring the foundational data that determines whether claims are even eligible for payment. That foundation is group provider enrollment. When the information attached to your group is inaccurate or incomplete, the financial consequences add up quickly.

Breaking Down the Enrollment Process by Specialty: Why Behavioral Health Is So Tricky

by admin |Nov 20th, 2025| 6 comments,

Provider enrollment is one of the most important steps in getting paid for healthcare services, yet it remains one of the most misunderstood. When it comes to behavioral health, the process can be especially challenging. Behavioral health providers face unique barriers that other specialties do not, from complex payer rules to documentation issues and credentialing backlogs. At Instapay Healthcare Services, we specialize in helping providers navigate these obstacles so they can focus on patient care rather than paperwork.

Fraud, Waste, and Abuse in Healthcare: A Medical Coder’s Role in Prevention

by admin |Nov 18th, 2025| 6 comments,

Fraud, waste, and abuse continue to challenge the healthcare industry, affecting patient care, financial stability, and compliance efforts. As healthcare organizations work to improve accuracy and accountability, the role of the medical coder has become more important than ever. Through accurate medical coding and strong compliance practices, coders help support threat prevention in medical billing and protect providers from serious financial and legal consequences.

Navigating Commercial vs. State Insurance for Chiropractic Billing in Washington

by admin |Nov 12th, 2025| 6 comments,

When it comes to chiropractic billing in Washington, one size does not fit all. Providers must navigate the nuanced differences between commercial insurance plans like Premera or Regence and state insurance programs like Apple Health (Washington Medicaid). Missteps in documentation, coding, or authorization can result in denied claims and revenue loss even for medically necessary care.

Telehealth has transformed the healthcare landscape by making care accessible to patients wherever they are. However, with this convenience comes complexity, especially when it comes to telehealth provider enrollment. Unlike traditional in-person practices, telehealth providers must navigate unique payer requirements, multi-state regulations, and licensing challenges that can make enrollment a time-consuming process. Understanding these enrollment considerations is essential for ensuring timely reimbursements and compliance.

Stuck in Payer Purgatory: Why Your Credentialing Application is Taking Forever.

by admin |Nov 04th, 2025| 6 comments,

If you are a solo provider or a new physician eager to start seeing patients and billing for your services, few things are as frustrating as being stuck in the black hole of payer credentialing. You submitted your forms months ago, but your credentialing application status remains unchanged: "Pending."

Healthcare providers face numerous administrative requirements to maintain compliance, stay enrolled with payers, and ensure uninterrupted reimbursements. Among the most commonly misunderstood terms are provider revalidation and provider re-credentialing. While they may sound similar, they serve different purposes and are required by different entities.

Solo Practitioner vs. Group Practice: Credentialing Requirements Compared

by admin |Oct 20th, 2025| 7 comments,

Provider credentialing is more than just paperwork. It is a critical process that determines whether a healthcare professional or practice can legally and ethically serve patients and receive reimbursement from insurance companies. Whether you are a solo provider starting your own clinic or a part of a group practice, understanding the differences in solo vs group credentialing is key to avoiding delays and ensuring compliance.

Navigating the Complexity of Dual Diagnosis Billing for Behavioral Health

by admin |Oct 14th, 2025| 7 comments,

In the world of behavioral health, providing comprehensive care often means addressing more than just one condition. Many patients experience both a mental health disorder and a substance use disorder simultaneously, a situation known as dual diagnosis. While treatment for dual diagnosis in behavioral health is critical to patient outcomes, billing for these services is notoriously complex.

Efficient operations have been at the core of a sound healthcare environment. This is not just for compliance, but for financial sustainability. One area that often gets overlooked yet directly impacts revenue is provider credentialing. Without timely and accurate credentialing, your providers can’t see patients, bill insurance, or get reimbursed. That’s why partnering with a professional credentialing service provider, like Instapay Healthcare Services, is not just a smart move; it’s a high-ROI investment.

How New Jersey Vision Plans Affect Your Ophthalmology Reimbursements

by admin |Oct 06th, 2025| 7 comments,

In the complex world of ophthalmology billing, one of the most frequently misunderstood aspects is the role of vision plans and how they impact reimbursements. For ophthalmologists practicing in New Jersey, navigating plans like VSP, EyeMed, and others can significantly influence your bottom line and if not managed correctly, could lead to underpayment or outright claim denials.

You've hired top talent, a new physician, PA, or NP, ready to see patients and boost your revenue. But then reality hits: provider enrollment. That critical process of registering your new staff member with insurance payers often takes months, leaving your provider benched and costing your practice thousands in lost billable hours.

Denied by a Payer? Here’s How to Appeal and Reapply Successfully

by admin |Sep 30th, 2025| 7 comments,

Provider credentialing and enrollment is the gateway to participating in insurance networks and receiving timely reimbursements. But what happens when your application gets denied by a payer?

EMR + Payment Integration: What Pennsylvania Optometry Practices Can Gain

by admin |Sep 29th, 2025| 7 comments,

In today’s fast-paced healthcare landscape, optometrists in Pennsylvania are seeking smarter, more efficient ways to manage their practice operations and that begins with modernizing the billing process. At Instapay Healthcare Services, we understand that accurate, timely billing is essential not only for healthy revenue cycles but also for a better patient experience. That’s why we strongly advocate for payment integration with EMR (Electronic Medical Records), especially for local practices offering eye care services across the state.

Handling Prior Authorizations in Ophthalmology Without Slowing Down Care

by admin |Sep 18th, 2025| 7 comments,

In ophthalmology practices, precision and timeliness aren’t just important in clinical care they’re equally vital in your revenue cycle. One of the biggest roadblocks to smooth operations is prior-auth for ophthalmological services. While prior authorizations are meant to ensure medical necessity, they can often delay care and payment if not managed efficiently. That’s why smart strategies in ophthalmology billing are critical to keeping both your patients and your bottom line satisfied......Read More »

Seasonal Trends in Chiropractic Billing and How to Plan for Them

by admin |Sep 18th, 2025| 7 comments,

If you’re a chiropractor practicing in Washington, you already know how essential proper documentation is, but not just for clinical continuity. The real make-or-break often lies in your SOAP notes. Payers, whether Medicare, Medicaid, or commercial insurers, use these notes to evaluate the medical necessity of care before they release payment.....Read More »

Billing Dental Services to Both Medical and Dental Insurers in New Jersey: When and How

by admin |Sep 10th, 2025| 7 comments,

Navigating the complex world of dental billing in New Jersey becomes even more challenging when a procedure qualifies for both medical and dental coverage. Many providers miss out on legitimate reimbursements simply because they don’t know when or how to bill both medical and dental insurers in New Jersey.....Read More »

For patients, a visit to the eye doctor might seem simplean exam, a prescription, and perhaps a pair of glasses. But for providers, navigating the maze of ophthalmology and optometry billing is anything but straightforward. One common source of confusion for both patients and practices is the distinction between vision and medical insurance billing....Read More »

How to Handle Self-Pay and Sliding Scale Billing Ethically and Efficiently for Mental Health

by admin |Aug 22nd, 2025| 9 comments,

Mental health providers in the USA face a delicate challenge: balancing accessibility for patients with the financial sustainability of their practice. With rising demand for mental health services and gaps in insurance coverage, more patients opt to pay out-of-pocket. At the same time, ethical responsibilities often lead providers to offer sliding scale fees to those in need. Handling self-pay in mental health and sliding scale billing properly is crucial to ensure compliance, sustainability, and fairness......Read More »

Seasonal Challenges in Dental Billing and How to Prepare for Them

by admin |Aug 13th, 2025| 9 comments,

Navigating mental health billing is already a complex task in itself, but when you add state-specific mental health billing laws into the equation, the challenges multiply. Every U.S. state has its own set of regulations that govern how mental health services should be billed, reimbursed, and documented. Understanding and complying with these laws is essential to ensure that claims are processed correctly and your practice maintains compliance. That’s where the expertise of mental health billing specialists like Instapay Healthcare Services comes in.